Independent Wealth Managers

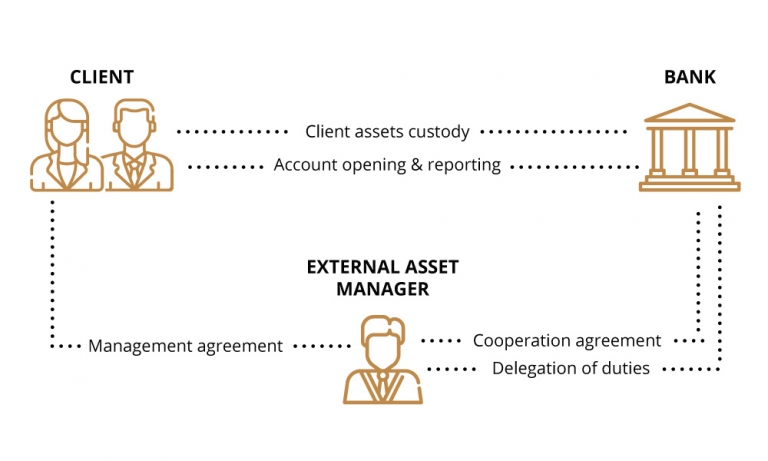

They sit outside of the remit of a private bank or traditional financial institution, which enables them to be better-trusted stewards of clients’ assets by aligning their interests entirely with their clients’ individual needs and objectives.

Concentrating on private investors and high net worth individuals, independent wealth managers are an important part of the wealth management landscape.

In this fast-changing and volatile market environment, the agility, client-centricity, and holistic approach to wealth management that EAMs offer, ensures that clients have bespoke solutions that are tailor-made to their needs.